Can You Sell a House in Probate?

Can You Sell a House During Probate?

Your Options and How to Proceed

When thinking of the future, consider what might happen to your home, assets, and property when you are gone. Most people are afraid to think of what might happen when they are gone. Without a plan, disagreements might arise, which can be lengthy and expensive to settle. After someone dies, their will takes effect, and the beneficiaries go through the probate process to settle the deceased instructions for their estate.

Some states allow pre-probate when settling estates to avoid the lengthy, expensive and hectic probate process. What is pre-probate? A probate is a legal process of determining and administering a person's estate after death and changing the property title from the deceased to their next of kin or heir. On the other hand, a pre-probate is the process of probating a will before death.

The Benefits of Taking Pre-Probate Actions

A pre-probate plan is useful to people who wish to save and protect their families and loved ones from the emotional and financial stress of settling their estate in court. Other benefits of a pre-probate include:

Unites Your Beneficiaries and Avoids Family Disputes

In most cases, disputes arise after the will is read among family members, especially when they are not content with what they get. Pre-probating your will assures your beneficiaries that what is in the will are your true last wishes, as it prevents disputes and provides closure among your family members.

Convenience

Probating your will before death does not mean it will take effect immediately, considering a will does not have effect until after the testator dies. However, pre-probating your will is convenient as it saves your loved ones the precious time and resources they might spend looking for your lost assets.

Makes Your Wishes Known

Probating your will before death allows you to tell your family and loved ones your final wishes. Only some people might agree with your wishes. It enables them to air their issues with you, not the court. Pre-probating allows you to settle any disagreement that might arise after making your last wishes known.

Pre-Probate Strategies for Protecting Your Assets

The thought that someday you will no longer be alive is unpleasant. Even though you might not be alive to manage your assets, there are strategies you can put in place to protect your assets. These pre-probate strategies include:

Utilize Transfer of Death Deeds

Death deeds allow you to transfer assets under a grantee-beneficiary at death without requiring investments to go through probate.

Consider Appointing a Trustee

Appointing a trustee to manage your assets is a good way to protect them since they distribute them appropriately. Assets under a trustee are also not subject to any estate tax since they are no longer considered yours.

Consider Gift Assets

If your assets are subjected to significant taxes making your loved ones earn less than you would have liked, gift them the assets when you are still alive. You are not subject to taxes when gifting assets.

Pre-Probate Planning for Your Family's Future

Consider your family's current and future needs when making pre-probate plans to protect your family's future. Some of the things you can take into account include the following:

Naming a Guardian for Your Children

Appointing a guardian when pre-probate planning protects your children and other family members from costly family court fights that might drain your estate's assets.

Documenting Your Wishes for Your Children's Care

Do not presume that certain family members share the same visions, ideas, and goals regarding child-rearing. Therefore, document your wishes for your children in detail when pre-probate planning for your family's future.

Ensuring You Have Enough Life Insurance

Your life insurance coverage depends on factors such as marital status and lifestyle. When planning for your family's future, life insurance is vital if you have a child with special needs or have college tuition bills.

Working with a Professional for Pre- Probate Planning

The best way to pre-probate a will is to work with a probate professional to learn about your options and focus on all the important details. Then, if you want your assets and loved ones protected when you can no longer do it, working with a professional helps you come up with a perfect pre-probate plan formulated per the law.

Probate Expertise You Can Trust

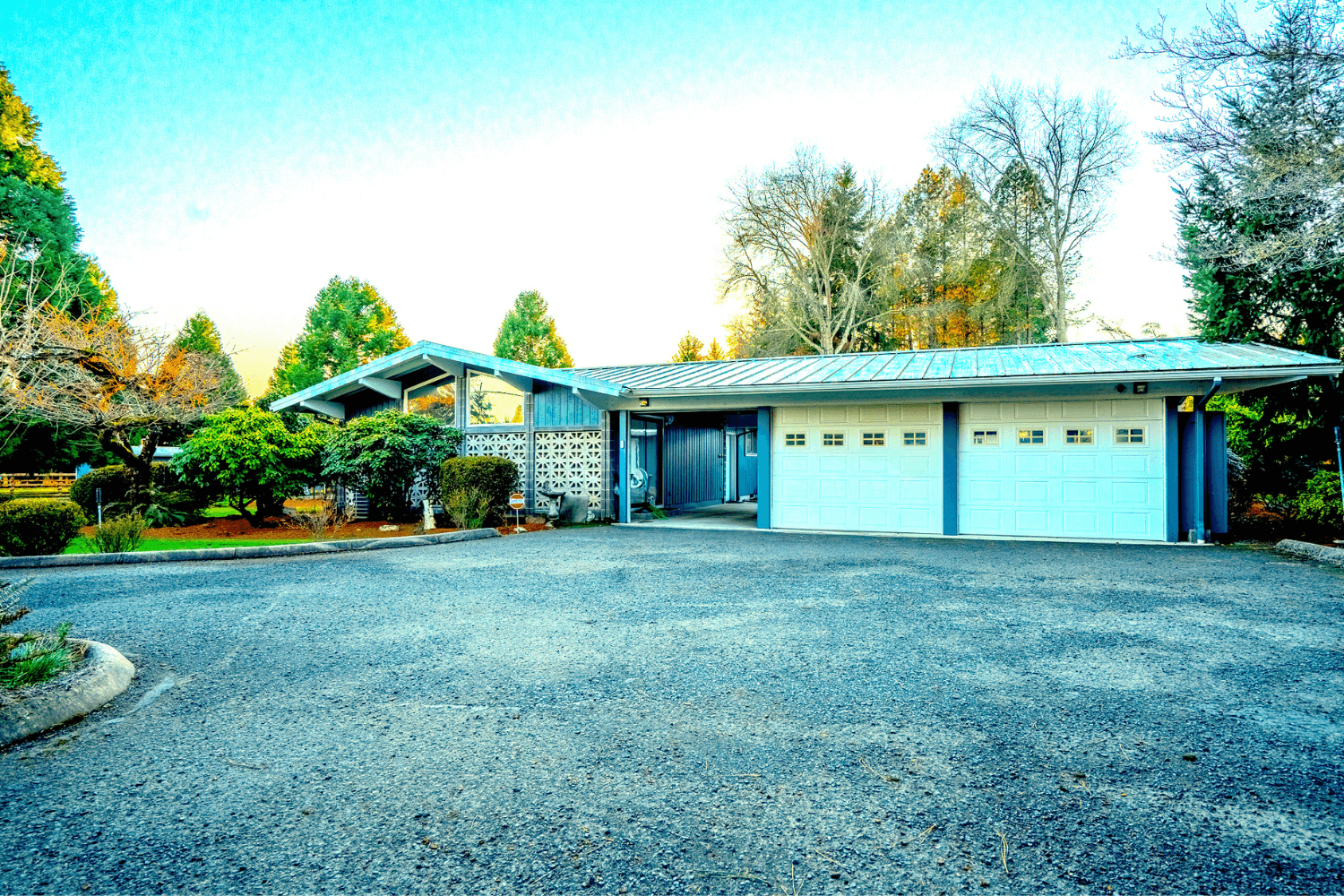

Now that you understand what a pre-probate is, seek help from probate experts to help you through the process. The Operative Group in the Eugene area has licensed experts to handle all aspects of probate. Contact us for more information.

The Ultimate Guide to relocating to Eugene, Oregon: Overcoming Challenges and Ensuring a Smooth Move